American Dynamism

Oof.

Or, you know, not:

U.S. markets slid Thursday in their steepest declines since 2020, as investors grappled with the threat that President Trump’s new tariff plan will trigger global retaliation and hurt the economy.

Major stock indexes dropped as much as 6%. Stocks lost roughly $3.1 trillion in market value Thursday, their largest one-day decline since March 2020.

The Dow industrials dropped 1679 points, or 4%. The tech-heavy Nasdaq, which powered the market higher for years, was down 6%, pulled lower by big declines in Nvidia, Apple and Amazon.com. The S&P 500, which fell 4.8%, and the other benchmarks suffered their sharpest declines since the early days of the Covid-19 pandemic.

The dollar meanwhile tumbled, with the WSJ Dollar Index suffering its sharpest decline since 2023. The 1.3% fall brought the greenback to its lowest level since October, a sign of unease over the growth outlook and fears that the flow of funds into the country will be sharply curtailed.

That was yesterday, and we’re at it again today:

The global rout in stock markets continued on Friday as worries deepened about a trade war, after China retaliated against President Trump’s sweeping tariffs with steep levies of its own on U.S. goods.

The S&P 500 fell 2.5 percent on in early trading Friday. The benchmark U.S. index on Thursday posted its worst daily loss since 2020, plunging 4.8 percent.

I had something else to talk about this week, about the “industrialization of IT,” and I would prefer to be there than here. But the implosion of the global economic order is a tough thing to cross-program against, and it is hard not to stare into the abyss, when the abyss runs you over.

Anyway, since we are here, I do want to make two brief personal points. First, people often have an idealized view of entrepreneurship, and in particular, of entrepreneurship in Silicon Valley. Founders are often imagined as daring young mavericks who risk it all to pound their dent into the world. They chase a dream with reckless abandon, with no regard for danger or their detractors. They go all in, hand after hand, until they win or die trying.

But the reality is much more mundane. Most startups, I suspect, are the children of opportunity and context—they’re founded by experienced employees who have careers, some savings, and an interest in trying something new. They aren’t going all in, or going for broke; on the contrary, they’re doing it because they can afford the risk.

When we started Mode twelve years ago, that’s the story I lived: I’d found a foothold in the tech industry, the economy was steady, and I felt that I had time to take a chance before I needed to start backing into a retirement plan. I had an implicit safety net, in the confidence I had in the industry behind me and the earning power I assumed it would offer. I didn’t work on Mode to chase a dream; I did it because it felt safe.

Perhaps that’s bad; perhaps the only companies that should exist are those that are all gas and no brakes, and are irresistible to their founders and employees. Perhaps rewiring how the economy works will trim Silicon Valley’s fat, and discourage opportunistic founders from starting unnecessary companies.1 Maybe this is the efficiency we need, the final end to the ZIRP carnival. YOLO.

But that seems awfully romanticized. Despite the lore of the wunderkind founder, there’s some evidence that experienced founders outperform junior ones. And even if the generational winners are built by college dropouts like Mark Zuckerberg, Dylan Field, and the Collison brothers, the mid-career founders are almost certainly the middle class of the tech industry’s startup successes. Though we like to act as if Silicon Valley works because it attracts the crazy ones and the misfits, its real power is in how it makes acting like a crazy misfit feel safe.2

In moments like these, it is tempting, I am sure, for venture capitalists to trot out their usual clichés, and to tell everyone to keep calm and build on. Keep your head down, and this too shall pass. Don’t get distracted by the voting machine; build for the weighing machine.

Sure. But building is not just a mindset. There is a time and context for it too—and it’s not only about policy, but also personal security. And the reality is that just as it’s hard to blog about startup nonsense in the middle of an all-consuming economic cataclysm, it is hard to leave jobs and build startups when the safety net underneath you is down.

—

As a second point, there are certainly some people who are motivated to build through the storm. I met two of them this week. Nearly every Democratic campaign is run on a few pieces of key software, and one of the most important ones is collapsing under thirty years of tech debt and sclerotic management. Campaigns are desperate for a new version, these two folks are building one, and they’re looking to raise a friends and family round from their first ground-floor investors. If you want to help out, email me.

The White Lotus Power Rankings

After episode six, we all hate Greg, we all love Rick, and we have no idea who’s going to die:

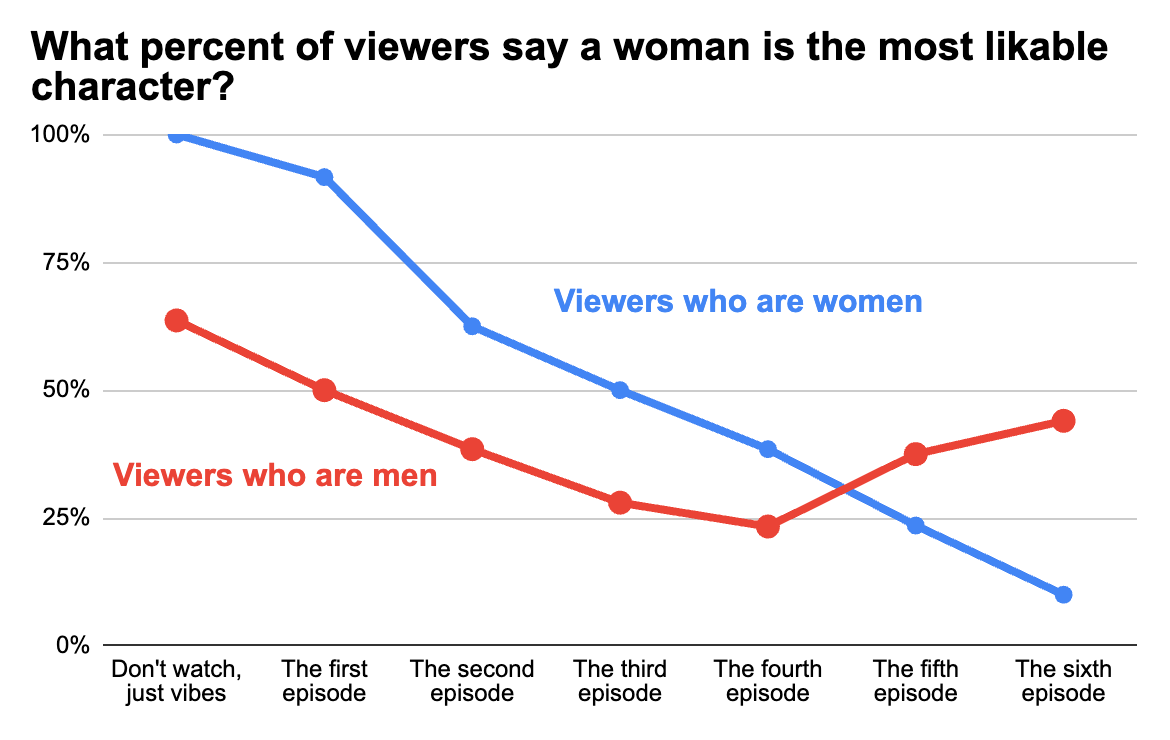

Some notes: Everyone is siding with Laurie in her tiff with Jaclyn; Mook begins to look a bit more like a murderer; and somehow, Rick, who ended episode six about to kill someone, suddenly isn’t suspicious at all. Also, the women characters continue their popularity plunge among women viewers:

Why? Mostly because Rick got a lot more popular—again, despite the whole “planning a murder” thing—and Victoria got a lot less popular. Plus, in a clean sweep, every woman said that Greg was the most deplorable character. Money can buy you a house and a yacht and a wife, but it can’t buy you love, I guess.

Anyway, we’re down to the wire! Who did it? What will Belinda do? How cooked is Gaitok? Is the theme song full of wee-woos or loo-loos? Why did Mike White cut them? Cast your final votes!

Or, perhaps this is all just an overreaction, and markets are going to boom.

For example, you can gamble with other people’s money, and failing as a founder isn’t punishing to your reputation.

It's time to build, something, something.

Not a bad analogy 🤔🗯️